How drivers could be hit

New tax rates for vehicles registered after 1 April 2017, have now come into place. As a result, some new car owners are now liable to pay £520 a year in tax – while drivers of eco-friendly vehicles have also been hit even harder. Here are the details you’ll need…

CHECK YOUR ROAD TAX AND MOT IS VALID RIGHT NOW

Cars registered on or after April 1 2017:

You will only be affected by this change if you bought a new car on or after 1st April, 2017. Tax rates for vehicles registered before this are calculated as they were before April.

Why has the change happened?

Now that a majority cars have become more efficient, the Chancellor has been hit in the pocket! So, despite moving to cleaner cars, the motorist is going to be hit for higher tax charges to make up for the cash lost by low-emissions vehicles that don’t attract any, or as much, road tax.

Does this mean I will have to pay more for a hybrid or low-emission car?

Yes – but only if you buy a vehicle first-registered after April 1, 2017. Buy a hybrid or low-emission car registered before April and you’ll enjoy huge savings in car tax payments – and help improve the environment at the same time. Here’s a quick example of how much a new car will cost

The following are examples of how much you’ll pay in VED (car tax) if you buy a new car now compared with one first-registered before April 2017. The prices include three-year ownership costs including the first-year charge.

NEW V NEARLY NEW

Fiat 500 0.9 TwinAir

Fuel: Petrol

Car tax for vehicle registered before April 2017: £0

Car tax for vehicle registered after April 1, 2017: £380

Change: +£380

A sub-100g/km city car such as the Fiat will now attract a first-year cost of £100 followed by a yearly bill of £100 for a Band D motor. Despite the car’s environmental credentials, post April owners will be hit by a £380 tax rise over 3 years.

Ford Fiesta 1.5 Duratorq TDCi Style

Fuel: Diesel

Car tax for vehicle registered before April 2017: £0

Car tax for vehicle registered after April 1, 2017: £400

Change: +£400

The Fiesta is the UK’s top-selling model and this 94g/km motor proved a big hit with its decent performance and low-emissions attracting £0 car tax. The post-April hit of £400 will make it far less attractive. Buy used for that £400 discount?

BMW 740d

Fuel diesel:

Car tax for vehicle registered before April 2017: £390

Car tax for vehicle registered after April 1, 2017: £1,100

Change: +£710

The luxurious BMW 740d was a pretty reasonable proposition for such a big car, but new rules will see it jump bands and take a hit from the new £40k premium. Buying nearly new will save that tax hike.

Examples of road tax savings if you bought a car first-registered before April 1, 2017

With the changes in road tax hitting new cars registered from April 1, 2017, buying a used car registered before this date could save you hundreds of pounds compared with three-year ownership costs for a new vehicle. Here are a few examples from Buyacar.co.uk.

| Car | List price | 3-year saving on April 1st car tax rates |

| Fiat 500 1.2 Pop | £11,350 | £380 |

| Audi A1 1.0 TFSI Sport | £16,845 | £400 |

| Seat Leon SC 1.4 EcoTSI 150 FR Technology | £21,310 | £380 |

| Mercedes A180d Sport Executive | £25,135 | £400 |

| Audi A4 Avant 2.0 TDI S line | £34,900 | £410 |

| Mercedes CLS 220d AMG Line 7G-Tronic | £47,495 | £840 |

| Land Rover Discovery Sport HSE Black 2.0 TD4 Auto | £41,720 | £710 |

What are the change in tax rates?

Anyone buying a brand-new car or motorhome registered since April 1, 2017, will pay the first year based on the vehicle’s CO2 emissions – however this first year payment will be based on heavily revised CO2 calculations and will likely see the charge double from current levels

The following year will see most vehicles move to the standard rate of tax which is £165 a year. However, zero-emissions vehicles – such as fully electric cars – will pay nothing.

New and current VED rates…

See what you could be paying here…

VED road tax charges for cars registered from April 2017

From April 2017, the amount you pay for VED (also known as road tax) will increase for most vehicle owners. Many motorists who buy low-emissions vehicles will find they have to pay VED for the first, time. The new VED charges are as follows.

| Emissions (g/CO2/km) | First year rate | Standard rate |

| 0 | £0 | £0 |

| 1-50 | £10 | £165 |

| 51-75 | £25 | £165 |

| 76-90 | £120 | £165 |

| 91-100 | £150 | £165 |

| 101-110 | £170 | £165 |

| 111-130 | £190 | £165 |

| 131-150 | £230 | £165 |

| 151-170 | £585 | £165 |

| 171-190 | £945 | £165 |

| 191-225 | £1420 | £165 |

| 226-255 | £2015 | £165 |

| over 255 | £2365 | £165 |

| Cars with a list price of more than £40,000 when new pay an additional rate of £355 per year on top of the standard rate, for five years | ||

VED rates for vehicles registered before April 1, 2017

By way of comparison to show the huge increase in charges, here are the rates that you’ll pay for cars first-registered before April 1, 2017…

| CO2 Emissions in g/km (tax band) | Annual rate |

| Up to 100 (A) | £0 |

| 101-110 (B) | £20 |

| 111-120 (C) | £30 |

| 121-130 (D) | £135 |

| 131-140 (E) | £165 |

| 141-150 (F) | £180 |

| 151-165 (G) | £220 |

| 166-175 (H) | £265 |

| 176-185 (I) | £290 |

| 186-200 (J) | £330 |

| 201-225 (K) | £360 |

| 226-255 (L) | £615 |

| Over 255 (M) | £630 |

Won’t this mean that new car sales will plummet?

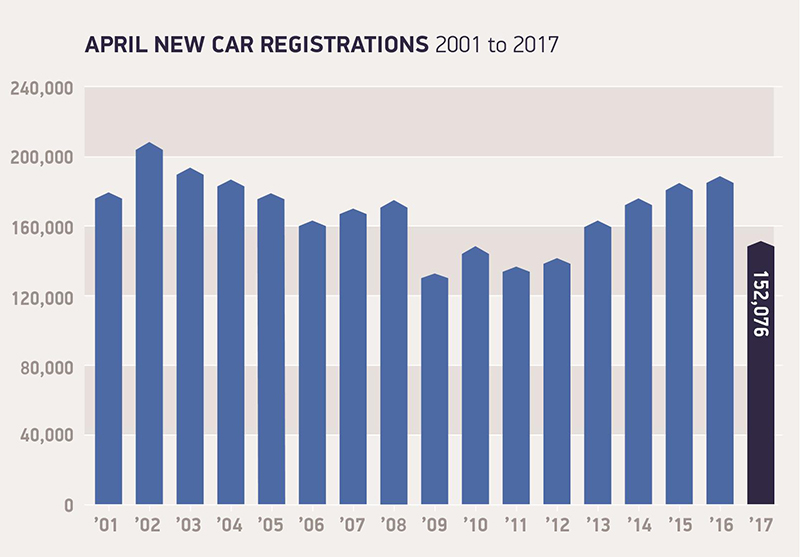

Yes! This has been proved to be the case with April’s new car registrations falling for the first time since 2011. This could mean some good deals are there to be had as dealers attempt to shift stock – but these cars will also attract the new, higher rates of road tax. Conversely, nearly new cars are likely to attract a premium as these will escape the new VED rates.

See how new car sales fell in April compared with previous years.

There’s more bad news…

Anyone buying a car with a list price over £40,000 at first registration will pay a total of £520 a year after the first year. After five years the tax will revert to the standard rate of £165… so a hefty premium will be payable.

Will I pay more for my tax if I buy a new car?

Yes and no… depending on your choice of car – and it’s not the gas-guzzlers that’ll be hit hardest in reality. While some ‘big-car’ owners will be slapped with a £355 supplement and £165 rate adding up to £520 a year, it’s motorists buying super-efficient eco-friendly cars that will lose the most… despite – many might argue – attempting to do the right thing for the environment.

Post April 2017, anyone buying a car that is rated at 100g/km or lower will pay £680 in VED over five years, whereas owner of such cars under the pre-April system would pay no VED. As the changes only apply to vehicles registered after 1 April 2017, buying a nearly new car will make big savings.

However, owners who buy a reasonably prices sporty car rated at 226g/km above, will, according to Auto Express, be better off if they keep it for more than the standard three years. Retaining it for five years would save almost £600, while holding onto it for a decade would put an extra £2,500 in your pocket.

Will I pay more for my current car after April 2017?

No. Current tax bands won’t change for cars that are already registered. This will remain the case if they are sold. This could result in sub-100g/km cars attracting a hefty premium when sold on the used market as they will still be charged no VED. The same can be said for higher-polluting vehicles, too, which will also retain the same VED rates for examples registered before 1 April, 2017.

READ MORE:

Dartford Crossing explained: How to pay and what to do if you forget

Electric cars for all officials. They sit outside awaiting their VIP occupants for long enough to recharge, so might encourage more charging points to be fitted.

the real reason the tax has gone up is to pay for all the toll bridges that the gov said people dont have to pay from watford gap down to the south but not up north unless they want your vote then when they get it they say you will still have to pay now the lying scumbags.

This sounds like a move in a game. If 50% of road vehicles were Eco-friendly electric hybrids the fuel companies would lose 50% of their revenue.

The more vehicles on road, the more research and development and advances in electric hybrids.

Fuel companies would lose a big slice of the pie in providing fuel to consumers.

Less sales. “Market dominance lives on…”

are the government going to increase the minimum wage once again????????? me thinks not so them who are on a low wage who have distance to travel and need a car as means of getting to work are going to be penalised due to not being able to justify the raise in road tax our government is a disgrace and I am ashamed to be called a british citizen

The goverment should go back to old way of car tax on engine size ie 1100 etc then every one pays the higher the cc the more you pay,then everyone knows what they have to pay.

Did our politicians consider the falling value of the pound in all this?

Okay so Brexit came afterwards but it is common sense inflation happens and in a couple of years, £50k might get me the same car I got for £39k today – what is the point in setting the luxury tax threshold so low?

If I buy a new car before 1st April 2017 will I have to pay the new rate of £140 for subsequent years? I’m a li’l ol’ lady driving 2000 miles a year, currently paying £20 tax a year.

Buy before April 1 and you’re on the old deal.

To me the fairest way is to do away with road tax and put the tax on fuel (even though its already mad) but that way you are paying for the milage that you are doing on the roads, for instance the company rep that does 40000 miles a year aposed to the old bloke down the road that nips into town once a week, if you want a big V8 its going to cost you to run it ! To me thats the fairest way!

I have been saying for years that all the road tax to be paid, should be by the fuel used.

The more road you wear out, and the more pollution you cause, the more you would contribute.

I would also include third party insurance, so that every road user is autmatically covered.

That would include include thieves and anyone else who might otherwise not be insured, for whatever reason.

One could also forget about SORN.

It would save a lot of grief.

There is already a tax on fuel. Therefore drivers who do 30,000 miles a year will pay more tax than a person travelling 10,000 miles a year. Getting them to pay even more more tax is totally wrong.

In what way is it “wrong”?

Here here Steve, have thought this for a long time. “Pay as you go!”

HI all, this has been going on for years and years, since I was a young man in fact. I am now 81 years old still got my marbles still drive my little car around and touch wood no other problems.

Hope the government put this to bed before I go.

If anybody is foolish to believe its due to the environment they should think again it’s about money making it’s not so long ago when the government wanted owners to purchase diesel vehicles, things have not changed

This is not very clear as to what will happen when buying a used car from a garage. Does this mean that cars previously paying for example £20 will now still have to pay the higher rate ?,

Used cars will not be affected

The goverment should put a road tax on cycles that use our roads. This could bring road tax down. Slightly after all they use our roads.

I agree on that road tax should not be on emissions it should tax to use the road and that final and and the money should be put back in to the roads as so meay cars are damaged evey year down to pot holes and cycles should have to have insurance if you own a car or a motorcycle then you should be able to add to that and children to 18years old are exempt from it

Can anyone please let me know if the suppliment charge applies to buying a second hand car older than 5 years?

New cars only.

All electric cars will pay similar prices for the electric used as petrol. I am a driving instructor and was recommended to buy a diesel but now the London money grabbing Mayor has put charges fo those with diesels entering London. We can’t win and what with the car tax increases I could be looking for another job like hundreds if not thousands of driving instructors leaving a shortage that will stop new drivers getting on the road hence loosing revenue on new vehicle sales and fuel. So how much are this stupid government going to loose in the long run.

Further to other comments, could I say that as a retired person driving approximately 4 thousand miles each year paying £185 road tax for the privilege, and exhorbitant insurance, I feel that a fairer way forward for road taxation would be to start with the huge number of foreign lorries who are damaging the roads and appear to pay nothing.

hi jeff I could not agree more with what you are saying I am an ex hgv driver retired and live in bucks we have no ring road and the amount of huge lorries are smashing our roads to bits,there are potholes some nearly a foot deep the drains are sinking there is not one main road around our town that you drive on where your car is not being shaken to pieces,our rates keep going up we are being bled dry with petrol increases I thought years ago that the road tax was spent on the road repairs now its just another way for the government to bleed us dry,if we are going to make England great again we will need to get our act sorted or we are heading for disaster.

Why,why,why don’t the DVLA charge even a nominal fee for electric and other ‘green’ vehicles? The rest of us are subsidising these vehicles, which also use the roads like the rest of us, causing wear-and-tear just like the rest of us – so they should pay a fair road-tax like the rest of us. Taking the government argument to it’s logical conclusion, when we all drive eco-vehicles, no-one will be paying any road tax, and the government will go bust! Let’s have some common-sense here!

Don’t be silly Peter, when we are all driving eco cars the government will find some reason to tax them. Look at what happened with Diesel cars! Get everyone to buy Diesel cars and then hit them hard with this and that. They are not as silly as they are green looking.

This is nothing to do with emissions and everything to do with robbery. As Brexit approaches we should be encouraging people to buy new items such as high value cars etc, this in turn creates jobs and taxation through income. This government appears to think opposite. I wonder if our MP’S will do away with their ministerial cars for all electric , or if it will be the usual case of do as I say not as I do.

Why do we continue to pay for these people’s extravagant lifestyles. We are the democracy not them, they should be answering to us. Ake away their privileges and see how they would then vote for less taxation etc. What a complete and utter disgrace.

The goverment come up with these so called brilliant ideas for low-emission car tax then the sting in the tail is the new charges if you try to improve on the veichle you drive